Inventory is the raw materials, work-in-progress, and finished goods that a company has on hand. However, there is a big difference between the two concepts.

In business, the terms "inventory" and "cost of goods sold" are often used interchangeably. As you can see, the cost of goods sold includes the cost of the inventory that was sold, as well as the direct costs associated with the production of those goods. The total cost of goods sold for Company XYZ is $100,000. The direct costs associated with the production of those goods were as follows:

Now, let's assume that Company XYZ sold $100,000 worth of goods during the year. The total value of Company XYZ's inventory is $60,000. Assume that Company XYZ has the following inventory on hand at the end of the year:

To further illustrate the difference between inventory and COGS, let's take a look at an example. COGS is an expense that is deducted from revenue to arrive at net income.

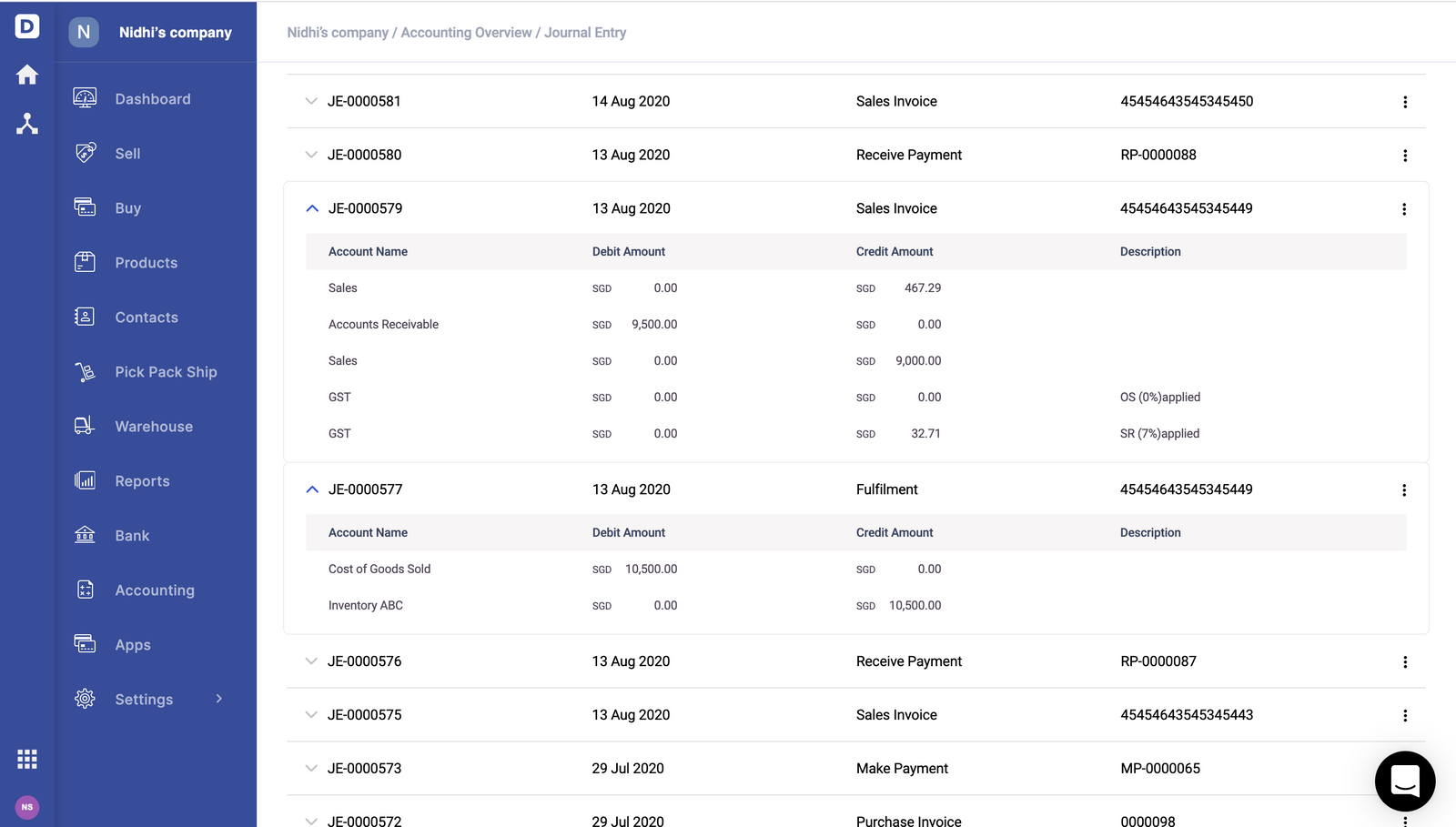

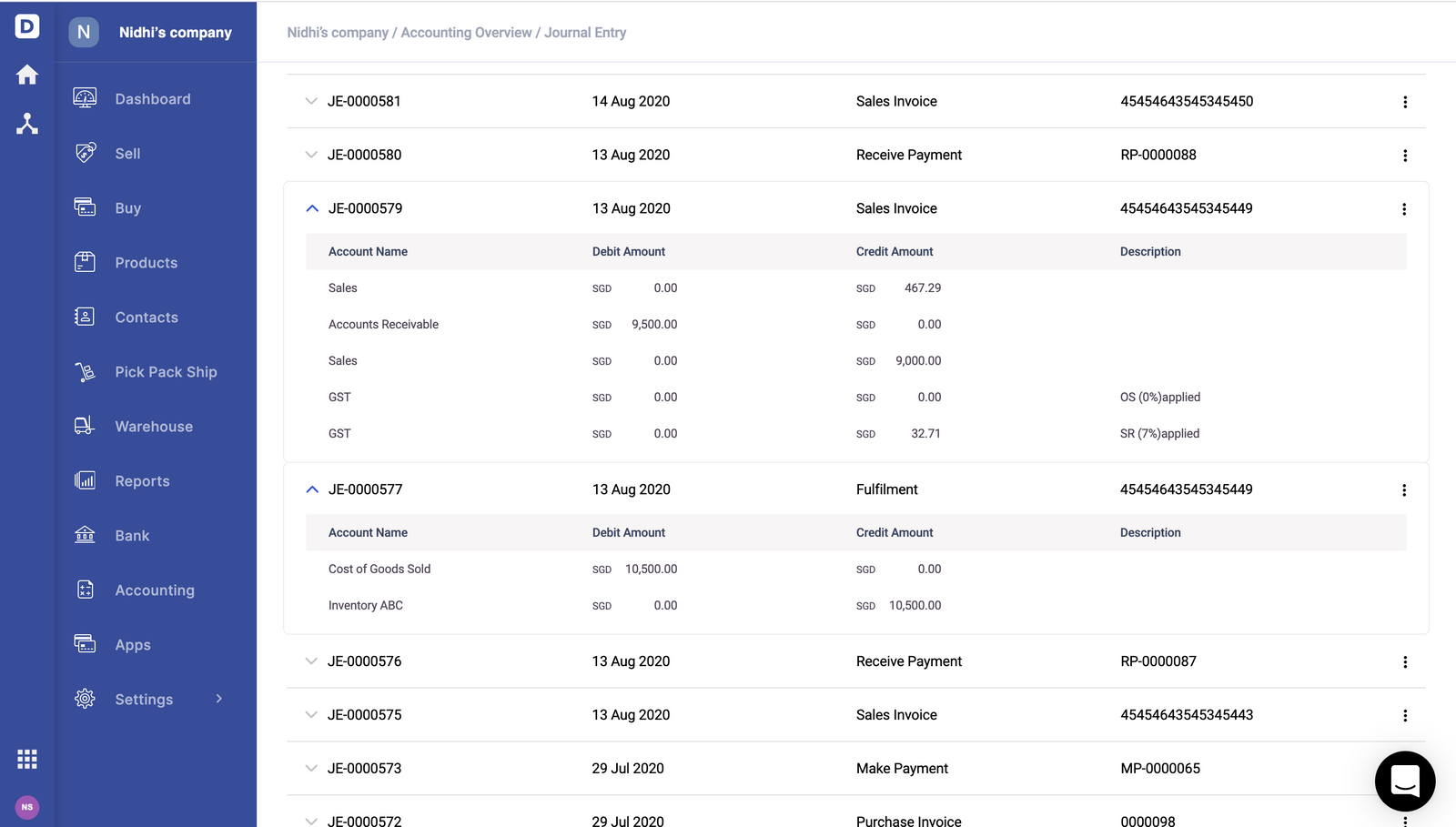

Inventory is a current asset, while COGS is not an asset at all. The value of COGS is not affected by the accounting method used. The value of inventory can be affected by the accounting method that a company uses. COGS only includes the direct costs associated with the production of the goods that were sold. Inventory includes all of the raw materials, work-in-progress, and finished goods that a company has on hand. Inventory is reported on the balance sheet, while COGS is reported on the income statement. Now that you know the definitions of inventory and COGS, it's time to take a look at the key differences between the two: The Difference Between Inventory and Cost of Goods Sold It does not include indirect costs, such as marketing, administrative, or research and development expenses. It's important to note that COGS only includes the direct costs of goods sold. COGS includes the cost of the raw materials, the cost of the labor to produce the goods, and the cost of any other direct expenses associated with the production of the goods.ĬOGS is reported on the income statement. What is Cost of Goods Sold?Ĭost of goods sold (COGS) is the direct costs associated with the production of the goods that were sold during a period. The goods that are last acquired are the first to be sold. Under the FIFO method, the goods that are first acquired are also the first to be sold. The most common methods are the first-in, first-out (FIFO) method and the last-in, first-out (LIFO) method. There are several different methods that companies use to account for inventory. The inventory account is a current asset, which means that it's expected to be sold or converted to cash within one year. The value of a company's inventory is typically reported on the balance sheet. Here's a look at the key differences between inventory and COGS. In business, the terms "inventory" and "cost of goods sold" (COGS) are often used interchangeably.

0 kommentar(er)

0 kommentar(er)